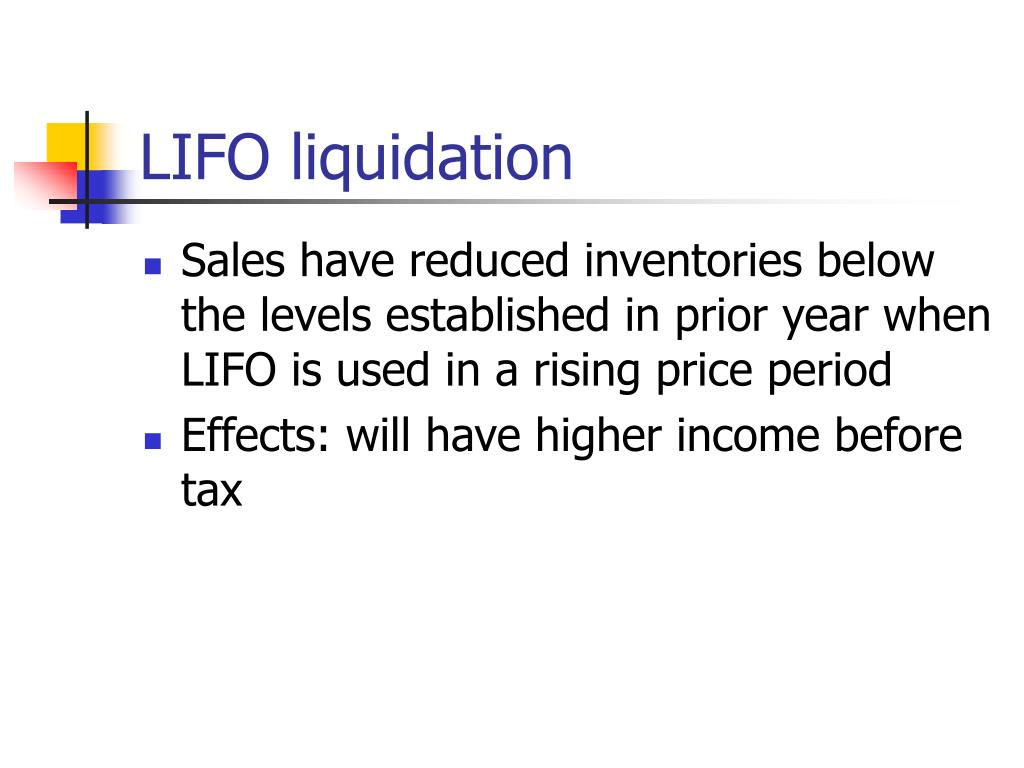

If the LIFO layers of inventory are temporarily depleted and not replaced by the fiscal year-end, LIFO liquidation will occur resulting in unsustainable higher gross profits. Whenever the number of units that are sold exceeds the number of units that are purchased or manufactured during a period, the number of units in ending inventory will be lower than the number of units in beginning inventory. In such a circumstance, a company that uses the LIFO method is said to experience a LIFO liquidation wherein some of the older units held in inventory are assumed to have been sold. One potential downside to LIFO is that it can lead to higher inventory costs as old items must be replaced frequently.

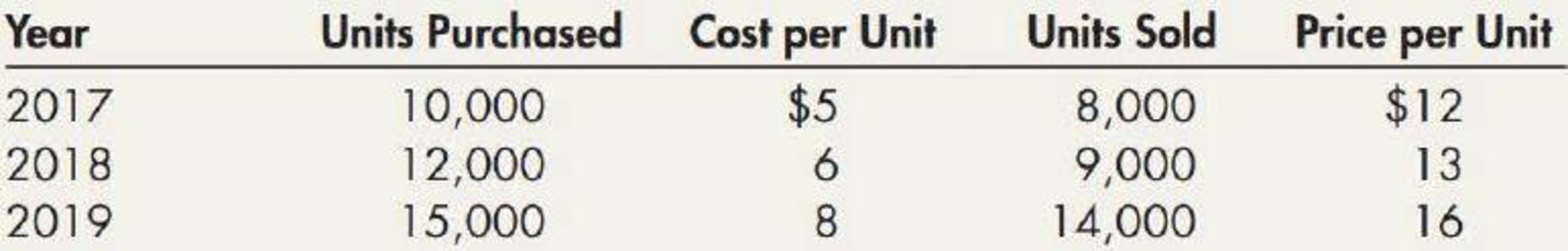

Purchase Behavior

Less than a month later, on August 3, 1994, the then superintendent of insurance, Sal Curiale, filed a petition to liquidate UCIC with the New York Supreme Court in Schenectady. In the meantime, the New York Liquidation Bureau was effectively dismantling the company under the rehabilitation order. In my next posting in this series I will discuss a current example of how the system could and should work under the existing statutory authority. The law requires that the superintendent be designated as rehabilitator or liquidator to take control of the assets of an insolvent company and liquidate or manage the estate. It also permits the appointment of deputies and assistants to support the superintendent in this role as receiver.

- LIFO Liquidation most commonly occurs when the company sells more items than it has purchased.

- Most companies that use LIFO inventory valuations need to maintain large inventories, such as retailers and auto dealerships.

- In other words, it occurs when a company using LIFO method sells (or issues) more inventory than it purchases.

- Since the company follows LIFO Method, 1 million units will be priced at the latest inventory.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

The Receivership Process in New York – Part I: What exactly is the Liquidation Bureau anyway?

The use of LIFO, especially in connection with the periodic inventory method, offers management a level of flexibility to manipulate profits. The result of this decline was an increase in earnings and tax payments over what they would have been on a FIFO basis. By switching to LIFO, they reduced their taxable income and their tax payments. Based on the LIFO method, the last inventory in is the first inventory sold.

LIFO, Inflation, and Net Income

Although the choice of LIFO over any other method does not affect the cash flow related to sales, it affects the cost of goods sold. The tax professionals in detroit, michigan’s effect on the cost of goods sold would affect gross income, which affects income tax, which in turn affects the operating cash flow. LIFO liquidation may also generate positive cash flow and result in higher taxable income and higher tax payments.

How confident are you in your long term financial plan?

In LIFO, the cost of inventory sold will base on the old purchase item, it is called the cost layer. But when the company sells a huge amount of stock, they will use all the items in the previous cost layer. As a result, the cost of inventory will equal the most recent purchase.

The Liquidation Process in New York – Part II: The Right Stuff

Most companies that use LIFO are those that are forced to maintain a large amount of inventory at all times. By offsetting sales income with their highest purchase prices, they produce less taxable income on paper. The cost of inventory may be decreased due to the market condition, which also impacts our financial statements.

Individuals who pay the non-discounted rate with cash or guaranteed funds will have a one-time, courtesy refund issued for the overpayment. Subsequent overpayments will have a $35 administrative fee deducted from the remittance amount (or charged against) the invoiced buyer. Please make sure you are paying the correct amount, per your means of payment.

With this calculation method, profits that are derived are more practical and realistic. Any period specified by the Secretary under subparagraph (B) may be modified by the Secretary in a subsequent notice published in the Federal Register. He shall publish a notice of such determinations in the Federal Register, together with the period to be affected by such notice.