Albert Einstein was arguably one of the most brilliant thinkers in the twentieth century. Although being a genius in one genre doesn’t guarantee illumination is all other areas of thought, observers can adapt Einstein’s philosophies of life and his personality traits into better approaches to money management and life in general. Einstein might have more to offer today’s thinking saver than just compound interest. Whether he said these words or something similar is relevant only to purists who say serious journalists shouldn’t attribute quotes willy-nilly to emphasize their importance. It doesn’t change the fact that compound interest should be on the mind of anyone looking to build wealth over time. QI hypothesizes that an anonymous advertising copywriter initiated the idea that compound interest was the world’s greatest invention or man’s greatest invention.

Compound Interest Is Man’s Greatest Invention

Fans of gurus will continue to stand up for their heroes despite displays of lack of character and lack of sense. Fans are invested in their heroes; to admit their guru isn’t perfect is to admit they wasted time, money, and energy. A superfan perceives an attack on Robert Kioysaki’s business practices or a criticism of his sales techniques as an attack on the man and his following. A criticism of Dave Ramsey’s approach to financial advice is dismissed without consideration; after all, he’s the successful author. He might have; the sentiment matches what seems to be this particular genius’s sense of humor.

With that being said, risk tolerance should always be considered with higher interest rates; a higher rate of return generally comes with additional risk. For savers, it means earning interest on your original principal—plus on the interest your investment generates. Compound interest is sometimes described as “interest on interest” because earned interest essentially gets added to the principal over time. Savings vehicles such as certificates of deposit typically pay compound interest.

Article Tags

His breakthrough in the understanding of the physical universe came from his ability to imagine how the world might incremental cost and cost work, and then ask himself questions and solve problems to determine which theories could be tested. For the most part, he let other scientists worry about the testing part, giving himself room for his thoughts to consider the world in ways no one had considered it previously. He didn’t like the militaristic nature of his schools, where pupils were not encouraged to ask questions, and learning was affected through rote memorization. The young Einstein had no interest in this type of training to blindly worship authority.

Not the answer you’re looking for? Browse other questions tagged economicsquotesalbert-einstein.

In 1916 a character in an advertisement in a California newspaper called “compound interest” the “greatest invention the world has ever produced”. Many homeowners who have struggled to meet their mortgages month after month, only to find after years of making payments that most of their money has computing sales tax gone to cover interest charges, have felt like cursing whoever came up with the concept of compound interest. Authority figures, like professors who lecture without open discussion and politicians, don’t always deserve to be trusted. And from a consumer perspective, we have to resist the temptation to consider salespeople authority figures or experts. Salespeople can cleverly disguise themselves as advisers, and skepticism helps protect people from making poor financial decisions.

One reply on “Compound Interest Is Man’s Greatest Invention”

For Einstein, advanced education is not job training, but training to perform at high levels in any situation, job or otherwise. This agrees with my view on education, with its worth being measured in more than just financial return on investment. Would Einstein feel the same way now, with a college education costing several multiples more than it did in his time, even after taking inflation into account? He clearly sees the importance of cognitive ability and education for growing human capital, which has a positive effect on options for long-term wealth. This economic philosophy doesn’t have a direct relationship with money management, but I thought it was interesting to note. Because of individual freedom, cherished by Einstein, we are able to build wealth for ourselves.

- He believed that humans were given brains so they could do much more than trust received knowledge unquestioningly.

- Also, regulations free from corruption help guide capitalism so that opportunities are available for more citizens.

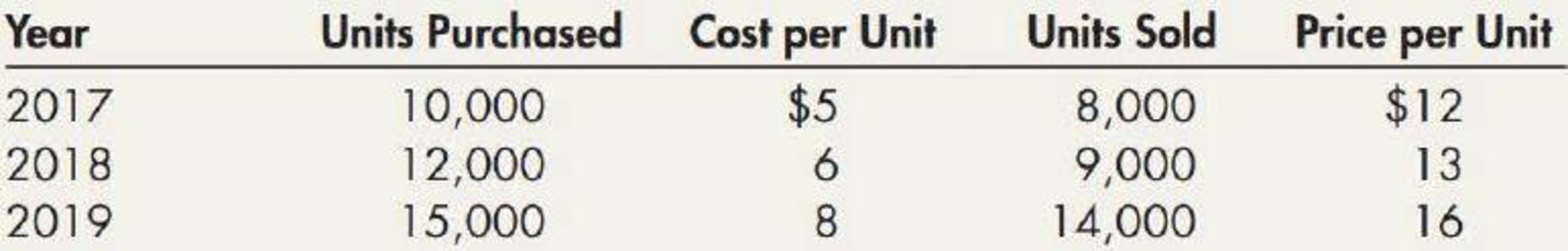

- These examples illustrate the importance of the interest rate and duration of your investments.

- This blog explains everyday economics and the Fed, while also spotlighting St. Louis Fed people and programs.

- A. Michael Lipper, president of Lipper Analytical Securities Corp., quotes Albert Einstein’s remark that “The eighth wonder of the world is compound interest.” If you can invest at a sure 7 percent return, your money will double in 10 years.

- FYI – Robbins’ exact line was “Compound interest is such a powerful tool that Albert Einstein once called it the most important invention in all of human history.”

Sometimes a comment is attributed to a famous individual to increase the prestige and believability of the comment. Also, a quotation from a famous person financial accounting for local and state school systems is often considered more interesting and entertaining. A. Michael Lipper, president of Lipper Analytical Securities Corp., quotes Albert Einstein’s remark that “The eighth wonder of the world is compound interest.” If you can invest at a sure 7 percent return, your money will double in 10 years. If you are patient, and stick with your investments over time, you will almost always come out ahead.